Customers in the UK are finding they are paying astronomically more for their gas and electricity: the energy price cap has exploded from £1,138 to £1,568 between 2021 and the third quarter of 2024 (July 1st - September 30th).

But how do these costs compare with other major economies, specifically Europe and the USA?

What is the historical context for Energy costs for consumers in the UK?

Energy prices in the UK are marked by significant fluctuations, brought about and influenced by both domestic and international events. In the post-war period, the UK enjoyed relatively stable energy prices, thanks in part to its substantial domestic coal production.

But it was the energy crisis of the 1970s - triggered by oil embargoes - that became the trigger the country's vulnerability to global energy market fluctuations.

In the following decades, the decline of the coal industry after the miner's strike in 1984, coupled with the opening up and liberalisation the energy market in 1996, meant even more levels of volatility.

Additionally, the creation of certain policies - such as the privatisation of the energy sector in 1986 and the Electricity Pool in 1990 (the creation of a wholesale market through which all generators could sell their output on the same terms), and the introduction of the Office of Gas and Electricity Markets (OFGEM) in 2000 further aided in reshaping the landscape.

And, while these changes aimed to introduce competition and drive down prices, they perhaps inadvertently laid the groundwork for the price instability that customers experience today.

It is also worth noting that the UK began domestic gas and oil production in 1967 and had managed to achieve full energy security in 2004. However, domestic production has since fallen out of favour, opening the country up to further susceptibility of global market dynamics.

What does the energy landscape look like currently?

Since the energy crisis in the UK first came to prominence in mid 2022, gas and electricity prices have grown to become a ignificant concern for both households and businesses.

And while certain measures have been implemented in an attempt to mitigate the impact of rising prices, such as the Energy Price Guarantee (EPG) which limited price increases for consumers during the winter of 2022-2023, energy prices have remained high compared to historical norms.

Add to this that, while energy prices have dropped throughout 2024, with current energy cap prices set at £1,690 for a typical household, forecasts indicate a rise for the next quarter of the price cap, with an increase of £33 to £1,723 in a response to an anticipated rise in wholesale energy prices.

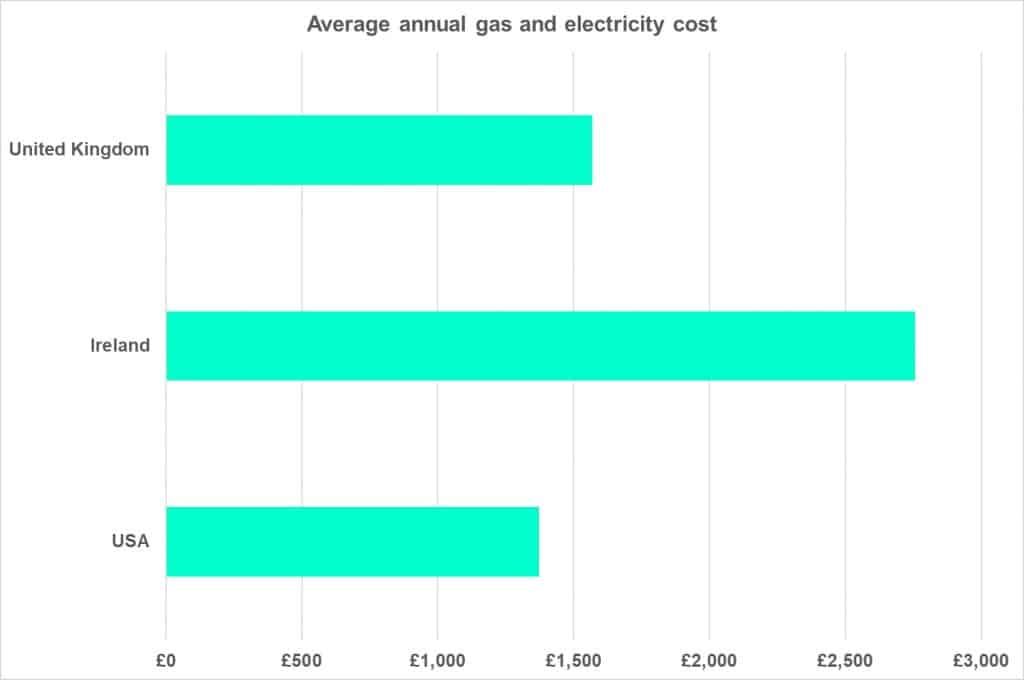

When compared with most other European countries, the UK's energy prices are notably higher. But there is one country that trumps the others when it comes to costs for consumers.

If not the UK, which country actually pays the most for its energy?

Second only to a handful of small island nations such as the Solomon Islands, St. Helena, and Vanuatu - whose energy costs are high due to their reliance on imported fuels and limited infrastructure - Irish customers pay the highest rates in the world for gas and electricity.

Residential electricity prices in Ireland are reported to be the highest across Europe, with costs reaching approximately 49.9 euro cents per kilowatt hour (c€/kWh). This rate is significantly higher than the European Union average, which sits at about 28.3 c€/kWh.

Why are energy costs so high in Ireland?

There are a number of factors contributing to Ireland’s high energy costs, including:

- Market Isolation and Size: Ireland's energy market is relatively small and isolated, which limits competition and increases vulnerability to price fluctuations. The country relies heavily on energy imports, particularly natural gas, which is subject to global market prices.

- Dependence on Imported Fuels: A significant portion of Ireland’s electricity is generated from imported natural gas. The costs associated with importing this fuel, combined with global price volatility, contribute to higher electricity prices.

- Energy Infrastructure and Sovereignty Issues: Ireland's ongoing transition to renewable energy sources, particularly offshore wind, has yet to bring substantial relief in terms of lowering costs.

The country's limited energy sovereignty and underdeveloped infrastructure play significant roles in maintaining high energy prices.

How does Ireland’s energy costs compare to the UK and the USA?

Ireland's electricity prices are slightly higher than those in the UK. In the UK, residential electricity prices are around 48.5 c€/kWh, which also places them among the highest in Europe, though still slightly lower than Ireland’s rates.

However, both countries face similar challenges, including reliance on imported fuels and the impact of the broader European energy crisis.

As of 2024, electricity rates in the United States are generally lower than those in the UK, with an average cost of arounf 13.9p per kilowatt-hour (kWh), whereas in the UK, it is around 22.36p per kWh.

What factors contribute to lower energy prices in the United States?

- Abundant Natural Resources: The USA has abundant natural gas, coal, and renewable energy resources, helping keep energy costs relatively low.

They're also a major producer of oil and natural gas, reducing the overall reliance on imports and helping stabilise prices. - Diverse Energy Mix: The U.S. energy mix includes a significant proportion of low-cost natural gas, nuclear power, and a growing share of renewable energy., meaning less volatility and a decreased overall cost.

The UK on the other hand relies more heavily on imported natural gas, exposing itself to global market forces of supply and demand. - Less Taxation and Regulatory Costs: The U.S. typically has lower taxes and regulatory costs associated with electricity generation and distribution.

In the UK, energy bills include higher taxes and levies aimed at supporting renewable energy and energy efficiency programs. - Market Structure: The United States has a more competitive energy market with numerous suppliers and regional grids, fostering competition and helping to keep prices down.

Here in the United Kingdom, while also competitive, we face different market pressures, such as higher infrastructure and maintenance costs associated with a denser population and older grid infrastructure.

How does the energy generation mix affect energy costs?

The composition of a country's energy generation mix is a critical factor influencing energy costs.

Currently, the UK's energy generation mix is one of renewables, nuclear, gas, and a small proportion of coal.

- Renewables: The UK has made significant strides in increasing its renewable energy capacity, particularly in wind and solar power. In 2024, renewables accounted for approximately 44% of the UK's energy generation.

- Nuclear: Nuclear power remains a significant component of the UK's energy mix, contributing around 16.4%. The stability provided by nuclear energy helps offset some of the volatility associated with renewable sources.

- Gas: Natural gas remains a crucial part of the energy mix, contributing around 36.7%. However, the UK's reliance on gas imports has made it vulnerable to global price fluctuations.

- Coal: Coal's contribution to the UK's energy generation has dwindled to about 2.1%, reflecting the country's commitment to phasing out this high-emission source.

Compared with Europe, the UK arguably has a much more diverse range of energy mixes, which has both advantages and disadvantages.

For example, France relies on nuclear power for more than 70% of its electricity. This allows France to maintain much lower electricity prices than the UK and other European countries.

Germany on the other hand, has a significant share of renewables in its energy mix, but its reliance on imported gas, particularly from Russia, has created vulnerabilities. The reopening of coal-fired plants in Germany following the Ukraine-Russia conflict underscores the challenges of transitioning to a fully renewable energy system while maintaining energy security.

In the USA, the energy generation mix is characterized by a significant share of natural gas, coal, and nuclear power, with renewables steadily increasing. The USA's vast natural gas reserves have allowed it to keep energy prices relatively low, despite global market pressures.

Case studies

Germany

When it comes to the challenges and opportunities of energy transition, Germany offers itself up as a unique and interesting case study.

The country's Energiewende (energy transition) policy, whereby in order to meet climate neutrality by 2045, began phasing out the use of fossil fuels and closing all nuclear and coal-fired plants, choosing to rely predominantly on renewables.

However, Germany's dependence on Russian gas prior to the Ukraine crisis meant that when sanctions were introduced, coal-fired plants had to be re-opened at an enormous cost.

Germany's experience underscores the complexity of managing a large-scale energy transition while maintaining economic stability.

United States

In the USA, Texas provides an interesting case study of the challenges posed by a deregulated energy market. The state's reliance on natural gas and renewables, combined with a lack of grid integration with other states led to significant energy price spikes and supply shortages during the 2021 winter storm. The storm, which lasted for more than 2 weeks, left more than 5 million people in the state without power, with 11 million experiencing an outage at some point, and some for more than 3 days.

During the sustained outage period, wholesale electricity prices rose to $9,000USD p/megawatt hour, the “system cap” set by ERCOT – the Electric Reliability Council of Texas. Under normal circumstances, electricity prices typically around $25 p/MWh. This almost unbelievable increase highlighted the need for better grid management, especially during times of extreme weather events.

Compare gas and electricity deals

We monitor the market and automatically switch you to better deals for free.